Filters

Category

Solution

The Future of Supply Chain Finance: Trends to Watch

The Future of Supply Chain Finance: Trends to Watch

In a recent Deloitte finance trends report uncertainty was reported as the number one concern for CFOs and their finance managers. And navigating a landscape this unpredictable requires more than just steady hands; it means getting on the front foot when it comes to understanding and embracing the technologies and strategies reshaping the industry.

We will take you through those critical trends defining the future of supply chain finance, and show you how you can leverage them to build a competitive edge.

1. AI & Automation for Predictive Finance

What is it?

We are moving beyond basic forecasting into the era of autonomous agents and predictive finance. This trend involves using AI to fuse purchasing, manufacturing, and finance operations into a single, cohesive plan. Instead of static spreadsheets, AI agents analyze historical data and real-time market trends to model risks and project demand with unprecedented precision.

Areas of importance

- Regulatory Compliance: Meeting strict reporting standards to avoid fines and reputational damage.

- Scope 3 Tracking: Gathering data on emissions produced by suppliers and logistics providers.

- Sustainable Sourcing: Prioritizing localized and green options over purely low-cost ones.

Benefits to business

- Early Warnings: Automated alerts allow for intervention before a small issue becomes a crisis.

- Optimization: Identifying and removing bottlenecks that slow down production.

- Data-Driven Decisions: replacing gut feeling with real-time analytics.

Potential impact on business

10/10 – AI is rapidly becoming a baseline requirement, not a luxury. Companies failing to adopt predictive tools risk being outmaneuvered by faster, data-driven competitors.

SAP Taulia recommendation

Look at areas where AI can drive maximum impact for the business such as AI-powered Cash Flow Acceleration. SAP Taulia uses “Intelligent Decision Automation” to analyze supplier behavior and recommend the optimal timing and discount rates for early payments. By using predictive spend analysis, you can maximize early payment adoption, ensuring your suppliers are funded while you optimize your own working capital yields.

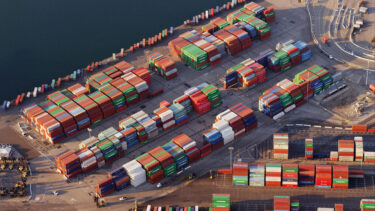

2. Resilience & Risk Management (Antifragile Design)

What is it?

This is the shift from “just-in-time” efficiency to “antifragile” design—building systems that don’t just survive volatility but leverage it. Strategies include nearshoring operations, multi-sourcing critical components, and utilizing dark stores (dedicated fulfillment hubs without in-store shopping) to speed up local delivery.

Areas of importance

- Diversification: Reducing dependency on single suppliers or regions.

- Proactive Monitoring: Tracking weather events, labor strikes, and geopolitical shifts before they halt production.

- Logistics Flexibility: Using dark stores to handle online order surges without disrupting retail operations.

Benefits to business

- Continuity: The ability to maintain production schedules when competitors are stalled.

- Agility: Faster reaction times to market changes or logistics failures.

- Customer Trust: Delivering on time, regardless of background chaos.

Potential impact on business

9/10 – As noted by Dassault Systèmes, disruption is now the norm. Resilience is your insurance policy against revenue loss.

SAP Taulia recommendation

Look for win-win scenarios that can benefit both you and your suppliers such as Flexible Funding. Resilience relies on the financial health of your suppliers. Taulia allows you to switch seamlessly between using your own cash (Dynamic Discounting) and third-party bank money (Supply Chain Finance) to pay suppliers early. This ensures your suppliers always have the liquidity they need to survive disruptions, securing your supply chain without straining your own balance sheet.

3. Deepening Visibility & Digital Twins

What is it?

A Digital Twin is a virtual replica of your entire supply chain that links supply, demand, and capacity data. When combined with IoT (Internet of Things) sensors and end-to-end visibility tools, it allows managers to track goods, financial health, and raw material prices in real time.

Areas of importance

- End-to-End Tracking: Monitoring everything from raw material sources to final mile delivery.

- Supplier Health: Using data to identify if a supplier is facing financial distress before they miss a shipment.

- Simulation: Running “what-if” scenarios in the digital twin to test responses to potential constraints.

Benefits to business

- Early Warnings: Automated alerts allow for intervention before a small issue becomes a crisis.

- Optimization: Identifying and removing bottlenecks that slow down production.

- Data-Driven Decisions: replacing gut feeling with real-time analytics.

Potential impact on business

8/10 – You cannot manage what you cannot see. Visibility is the prerequisite for all other optimizations.

SAP Taulia recommendation

Focus on increasing transparency by leveraging tools such as Cash Analytics. Taulia provides a “financial digital twin” view of your supply chain by giving you deep visibility into cash flow and supplier payment behaviors. Use this data to identify which suppliers might need early payment support and to forecast your own liquidity needs with greater accuracy.

4. Sustainability & ESG Integration

What is it?

Sustainability is no longer optional; it is regulatory. Companies must now track Scope 3 emissions (emissions from the entire value chain) to comply with regulations like the EU’s Corporate Sustainability Reporting Directive (CSRD) and Germany’s Supply Chain Due Diligence Act.

Areas of importance

- Regulatory Compliance: Meeting strict reporting standards to avoid fines and reputational damage.

- Scope 3 Tracking: Gathering data on emissions produced by suppliers and logistics providers.

- Sustainable Sourcing: Prioritizing localized and green options over purely low-cost ones.

Benefits to business

- Risk Mitigation: Avoiding non-compliance penalties and “greenwashing” accusations.

- Brand Value: Meeting the rising ethical expectations of consumers and investors.

- Long-term Viability: Ensuring your supply chain is compatible with a low-carbon future.

Potential impact on business

9/10 – Regulatory pressure is escalating rapidly. As PwC notes, Scope 3 emissions often account for the majority of a company’s carbon footprint.

SAP Taulia recommendation

Ensure your supply chain is not overlooked in your ESG strategy and adopt Sustainable Supplier Finance. You can use your supply chain finance program to incentivize ESG behavior. Taulia allows you to offer preferential early payment rates to suppliers who meet specific sustainability metrics (e.g., ESG ratings). This turns your accounts payable process into a powerful tool for driving Scope 3 reductions and tracking compliance across your network.

5. Workforce Evolution & Upskilling

What is it?

The role of the finance professional is undergoing a fundamental shift. We are moving away from manual data entry and reactive reporting toward a model where AI agents act as colleagues.

This trend isn’t about replacing people; it’s about upskilling teams to become data-literate strategists who can interpret complex AI-driven insights and oversee autonomous agents handling daily tasks.

Areas of importance

- Data Literacy: Upskilling staff to understand, question, and act upon the complex data streams provided by real-time analytics.

- AI Collaboration: Learning to work alongside AI agents that handle reporting, exception identification, and forecasting.

- Strategic Shift: Moving staff focus from “gathering data” to “making decisions based on data.”

Benefits to business

- Speed: AI agents can rapidly analyze vast datasets, providing management with options as circumstances change.

- Precision: Reducing human error in forecasting and routine processing.

- Empowerment: Staff are freed from repetitive tasks to focus on high-value activities, such as supplier relationship management and strategic planning.

Potential impact on business

8/10 – Technology is only as good as the people wielding it. Without a workforce capable of interpreting AI insights, your expensive tools become expensive paperweights.

SAP Taulia recommendation

Leverage Automated Workflows to Elevate Your Team. SAP Taulia’s platform automates the heavy lifting of invoice processing and supplier onboarding.

This directly supports workforce evolution by freeing your procurement and finance teams from transactional drudgery, allowing them to focus on strategic resilience and “exception-based” management—where they only intervene when the AI flags a specific issue.

Shifting Tech Landscape (XaaS & Edge Intelligence)

What is it?

The rigid, monolithic software of the past is being replaced by Everything as a Service (XaaS) and localized Edge Intelligence. This shift favors flexibility over ownership, allowing businesses to access powerful supply chain tools via the cloud on a pay-as-you-go model, while “Edge” tech enables faster decision-making closer to where the data is created (e.g., at the warehouse or port).

Areas of importance

- XaaS Adoption: Moving to cloud-based services to eliminate large upfront capital costs and ensure automatic software updates.

- Scalability: The ability to scale tech resources up or down instantly as business complexity grows.

- Mitigation Planning: Using advanced tech to run “what-if” scenarios (e.g., “What if a key supplier goes bust?”) before they happen.

Benefits to business

- Cost Efficiency: shifting from CapEx to OpEx with predictable pay-as-you-go models.

- Agility: Automatic updates mean you always have the latest features without lengthy upgrade projects.

- Resilience: Edge intelligence enables localized decision-making even when central connections are disrupted.

Potential impact on business

7/10 – Operational agility is a key differentiator. The ability to deploy new capabilities (like a new financing program) in weeks rather than years is a massive competitive advantage.

SAP Taulia recommendation

Adopt a Cloud-Based Working Capital Platform. SAP Taulia is a prime example of the XaaS advantage—it integrates deeply with your ERP (like SAP S/4HANA) but resides in the cloud.

This means you can deploy new capabilities, such as switching from Dynamic Discounting to Supply Chain Finance, instantly without a heavy IT lift.

Providing you with the “what-if” agility to adjust your funding strategy quickly in response to market volatility.